In an alluringly-titled but complicated article published in Advertising Age last week [1], there is good news: Yes, Martha, digital does sell soap. Then, the asterisks and qualifiers start. But even in these, there is interesting learning.

The general focus here is what the world’s biggest marketing spenders, the fast-moving consumer packaged goods (FMCPG) giants, have learned about digital since they discovered it as a marketing tool in 1994. Wait a minute—it has taken almost 20 years to prove that digital sells soap? It took only a couple of years to prove TV sells soap in the Mad Men era…

There’s complication even on what digital refers to. In the context of this article, digital isn’t including social media content, it’s really referring to paid display advertising on the web and social media sites, and search. Despite its 1 billion plus worldwide users [2], another highly-qualified number, social media (content) takes a longer time to sell soap to people through than other options, so FMCPG companies haven’t researched it much yet.

Despite what you might think, digital currently represents only 10% of ad spending for the big FMCPG companies, but that proportion is still growing. It makes perfect business sense that marketers keep increasing their digital spend up to the point of clearly diminishing returns, and we’re not there yet.

It turns out that TV and digital work differently as ad mediums for soap marketers. TV has huge reach. Digital has more targeted reach and can achieve it faster, but its scale is much smaller. Based on arithmetic, that means digital can have higher ROI than TV, but it maxes out much sooner, so TV wins on ROI in aggregate. Some experts in the article consider digital complementary to TV, some just consider it different.

And just at the end, as I was about to nod off and have to start all over again, this came along:

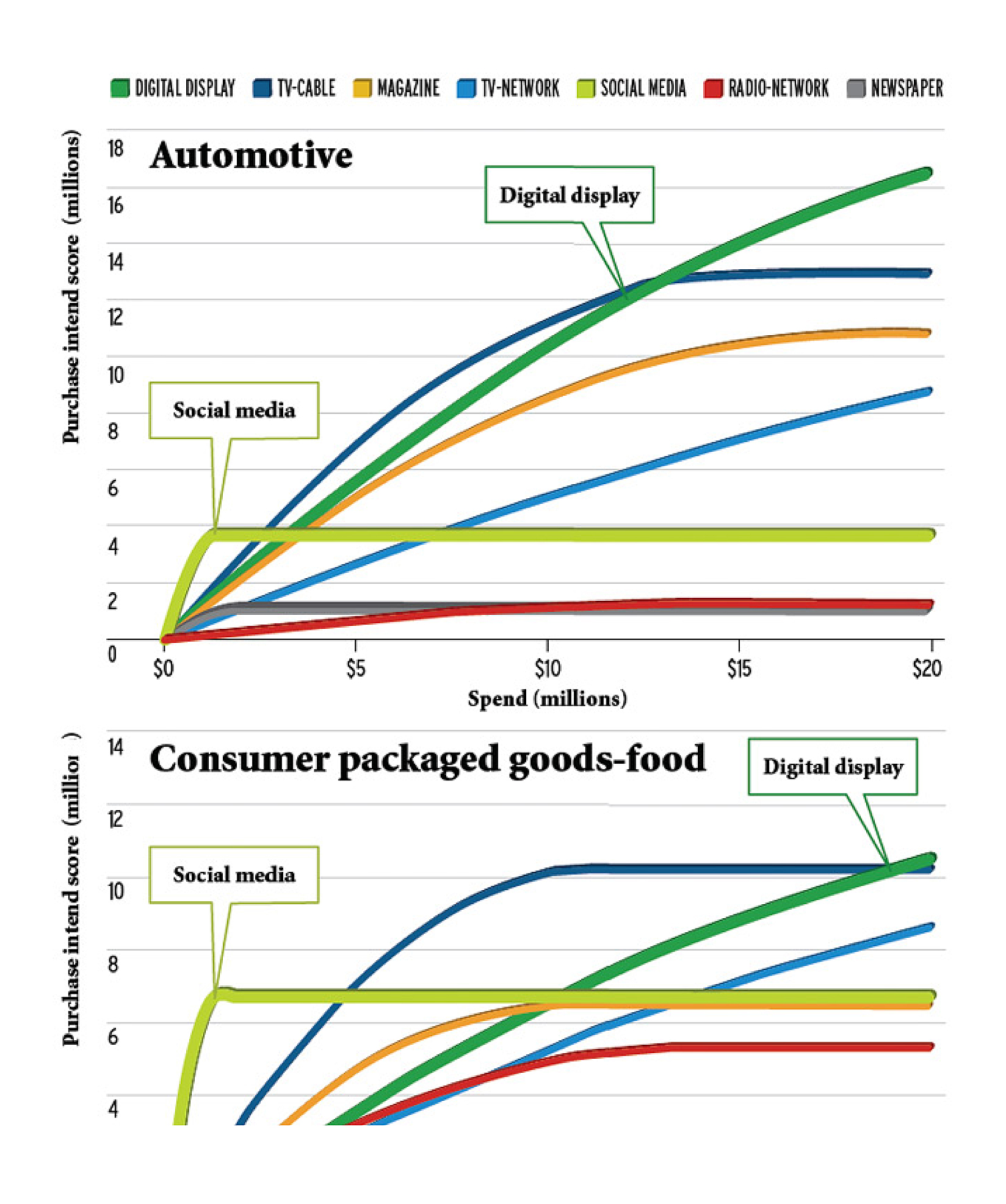

In a long ranging US-market research study that correlated ad spending to purchase intent for multiple media and multiple product categories, digital display surpassed TV-cable in effectiveness at the $20M spend level, and didn’t appear to plateau, and became even more effective at lower spend levels in the automotive category. In both product categories, social media has the strongest performance at very low spend levels, and plateaus, just like any media early in its development. Here’s the graphic graphic [3]:

|

| (click to enlarge) |

Does this make sense? Return to the consumer’s purchase decision process, and it does: consumers don’t spend time scouring the web to research what kind of soap to buy. But they spend many hours researching their next car.

- “The Truth About What Works in Digital Marketing“, Advertising Age, June 17, 2012.

- “Trends in Telecommunications Reform 2012“, International Telecommunications Union.

- Original source: Marketing Evolution, Inc.