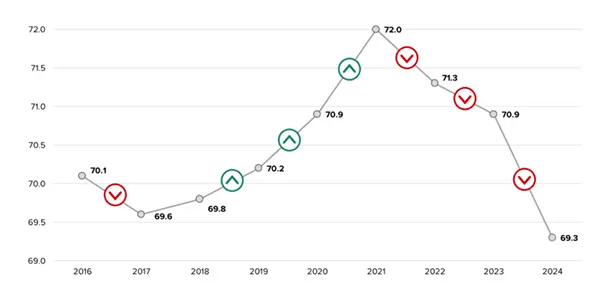

Starting in 2016, Forrester Research has been doing an annual Customer Experience (CX) Index survey to measure the consumer perception of CX quality in North America. Senior marketing executives are also surveyed on topics related to the survey. The most recent study (2024) showed the lowest average CX quality level to date. This was across all industry categories except airlines—but that’s another story, see sidebar, right. Canada and the US showed very similar trends.

This was a surprise to us, given the amount of time and energy that marketing people are putting in to improving CX. What’s going on here?

The Backgrounder

The term customer experience started appearing regularly in North American marketing literature in the late 1990s and early 2000s, driven by the onset of the worldwide web and online retail. By the mid-2000s, customer experience management (CXM) as a formal discipline, with research/consulting companies like Forrester popularizing CX as a key business differentiator. From 2010 onward, CX became a dominant focus in marketing and business strategy, especially with the rise of omnichannel experiences, digital transformation, and customer journey mapping.

In some industries (financial services, healthcare, SaaS, etc), CX has become a strategic business priority beyond marketing, where the most senior CX executive often reports directly to the CEO, COO, or Chief Customer Officer (CCO) rather than marketing. This structure is more common in companies that believe great CX requires the integration of functional areas beyond marketing.

Forrester’s CX Index has three major components, all of which showed decline:

- Effectiveness

- Ease

- Emotion

Key Findings & Possible Causes [1,2]

- 81% of senior executive surveyed define their company as ‘customer obsessed’, yet only 3% are actually doing the things that Forrester believes defines the term.

- Employee Experience (EX) may be suffering, specifically through return-to-work policy and technology investments affecting staff, which can directly affect CX.

- Forrester is assuming a big ‘pandemic effect’ as companies move from external thinking and acting, which focusses on the customer, to internal thinking and acting, which focusses on profitability.

- 67% of companies have invested in chatbots. 58% of consumers say they have used them. 16% say they use them regularly. Forrester calls chatbots a CX failure, and Gen AI (essentially ‘smart chatbots’, at this stage) can’t yet get over this.

- Higher income consumers were finally (and for the first time) reporting a decline in quality of CX.

- Brands that push or signal social-political values may be disenfranchising a large portion of consumers in a politically bifurcated environment, a greater issue for the US than Canada. An example is Bud Light’s collaboration with transgender influencer Dylan Mulvaney in a 2023 social media promotional post. Brand value may now be more important than brand values or company values.

Where Forrester Didn’t Go

If you’ve done any shopping the old-fashioned way over the last few years, you may have noticed your favorite major retailer increasingly appears to be in lockdown mode. Even some $10 products are under lock and key, requiring one to find an employee before you can see, touch and smell your desired item—once the undeniable advantage of the retail store over online shopping. And when you do find an associate, you may be escorted directly to a cashier for payment. It’s back into the store if you have more shopping to do.

While we all know why this is happening [3], it negatively impacts the customer experience. RDIF technology could be a solution, but that’s been talked about for almost 30 years now. Major retailers like Walmart are experimenting with RDIF tags in some product categories, in some market areas.

The less expensive fix for retailers is to push more shopping online, the CX quality of which is still a work in progress.

Lessons for Marketers

- A CX quality index of 69 seems low. But it’s an average, so there is opportunity for brands to stand out with real CX improvements.

- If your brand isn’t in Forrester’s survey, do your own consumer research to see where you stand. Like SWAT analysis, CX quality is difficult for most companies to objectively assess on their own. Re-read Key Finding #1 above—survey says you may not be doing as well as you think.

- Until Gen-AI gets better at delivering CX directly to customers, focus on using it to help employees deliver quality CX.

- Pete Jacques, “Overall Canada Customer Experience Quality Drops To A Historic Low“, forrester.com, Jun 18, 2024.

- David Truog, Pete Jacques et al, “What’s Behind The Decline In CX?”, forrester.com podcast, Aug 1, 2024.

- Susan Krashinsky Robertson, “The $9.1-billion problem“, The Globe and Mail, Jan 24, 2025.