Along with many others, I believe that demographics are the foundation of consumer marketing. Demographics help you define and understand your brand’s target group, which allows you to develop creative and media strategies and plans that maximise business results.

When don’t demographics matter?

- When you have a true new-to-the-world invention (along the lines of the movable type printing press or the cure to cancer), in which case, the world really does beat a path to your door.

- When you a have the clear and significant low-cost solution to a problem that every consumer needs resolved.

If you are in the .5% of all consumer brands for which one of the above is true, please read no further.

Okay, now that we’re down to a more manageable group of readers, let’s continue. Any current discussion of marketing needs to consider the Millennial cohort.

The Numbers

The Millennial cohort is big in numbers but smaller in purchasing power, individually and therefore in aggregate, than Baby Boomers or Gen X. This means that a play for Millennials is a play for the future. How far in the future depends on your product or service category.

There’s no question that Millennials are currently the most important cohort for mobile phones, fast food/fast casual restaurants, running shoes, taxi service, etc. In my opinion, marketers of luxury automobiles, financial services, need to know their Millennial-targeting imperative is further off in the future.

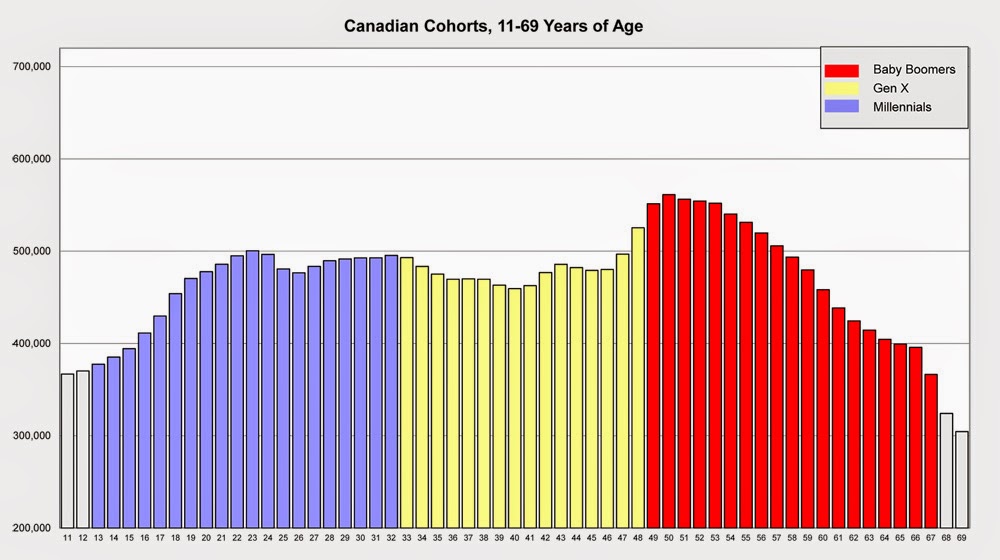

Here is what the key demographic cohorts for Canada and the US look like when plotted by year-of-age and using the generally-accepted cohort definitions. [1]

|

| Canadian cohorts, 11-69 |

These charts make it look like Millennials are bigger than Baby Boomers and Gen X. But this 2013 census data starts Millennials at 11 years old, when they may well be purchase influencers, but are unlikely to be primary purchasers of anything until they are 17 or 18. So for practical (and beverage alcohol) purposes, let’s start Millennials at 19 years-of-age.

|

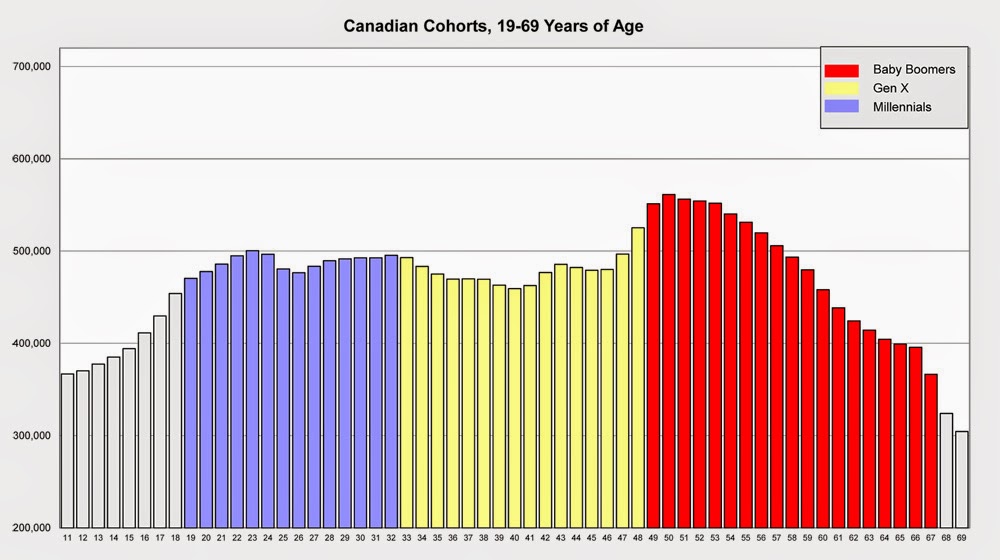

| Canadian cohorts, 19-69 |

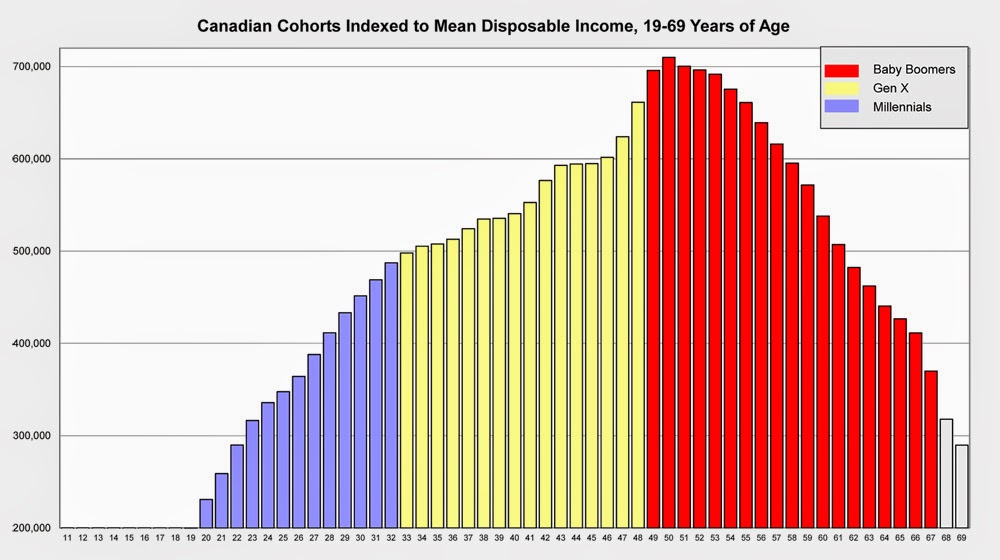

Now add the fact that younger people have less income to spend and the picture changes further. Wow!

|

| Canadians 19-69, indexed for mean disposable income |

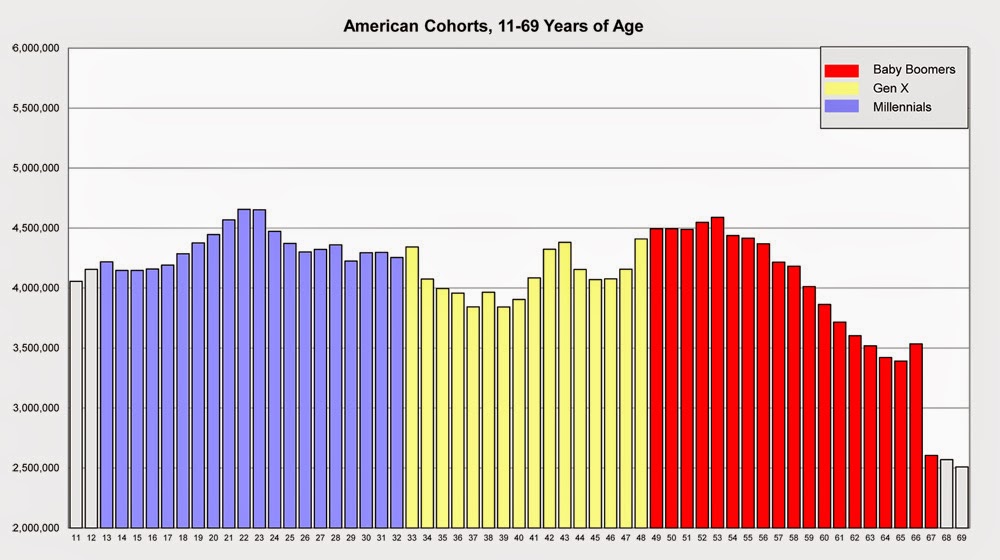

The American and Canada cohorts have always been a little different, starting with the Baby Boomers. The peak of the America Millennial curve actually looks down on the Baby Boomers, which clearly gets everyone excited about the former, but the total Millennial cohort proportion is actually very close in proportional size for the two North American neighbours.

|

| American cohorts, 11-69 |

The Common Sense

The premise of what I am about to say is paraphrased from seminal Canadian demographics work done by Dr David Foot: [2]

“Throughout recent history (the last 50-100 years), humans have tended to value and want the same things at the same life stages, and there doesn’t seem to be a good reason to think that will change in the near future.”

If Millennials are confusing and elusive to marketers (who aren’t Millennials themselves), it’s mostly because they communicate and connect differently than previous generations, most of which is based on technology, and their life-stage timing being different. Millennials become much more like the cohorts ahead of them as soon as they start having children, which starts 5 to 10 years later than it did for Baby Boomers.

In a trend that’s still developing, Millennials are also less likely than older cohorts to have children, a key trigger for home owning and car buying, and this trend isn’t entirely based on economics. When we understand the Millennial life-stage timing, we will understand a lot more about their consumption behaviour.

Conclusion

All marketers need to look at Millennials in a balanced way to determine when they become the primary or strong secondary target group for a brand. This is essential because Millennials are more expensive to market to than Baby Boomers or Gen X, largely because they require multi-platform campaigns to reach with good overall reach and frequency. And very few campaigns that are strategically and executionally right for Millennials will work for earlier cohorts as well, and vice versa.

- Created from most-current postcensal data provided by Statistics Canada & the US Census Bureau.

- David K. Foot and D. Stoffman, Boom Bust & Echo: Profiting from the Demographic Shift in the 21st Century, Toronto, ON, Canada, 2001